Fueling Global Trade — Financing

Without Borders

Empowering businesses worldwide with smart, secure, and scalable trade

finance solutions — from instruments to implementation, we bridge every

market

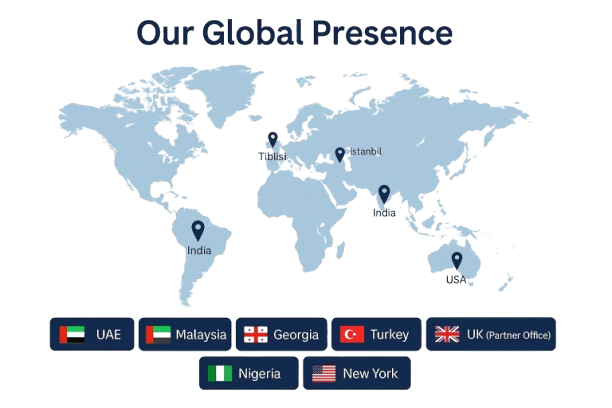

📍 Contact Our Global Offices

Find your nearest branch or connect with our global team below. We’re always here to help you!

| 🌎 Country | 🏢 Branch Office | 📬 Contact Email |

|---|---|---|

| 🇦🇪 Dubai (UAE) | Downtown Business Tower, Sheikh Zayed Road | zvsdubai@zvsinternational.com |

| 🇮🇩 Indonesia | Jakarta Financial Center, Sudirman, Jakarta | zvsindonesia@zvsinternational.com |

| 🇬🇪 Georgia | Building 7, Tengiz Buachidze Street, Vazha-Pshavela Avenue, Tbilisi, Georgia. Postal Code: 0177 |

zvsgeorgia@zvsinternational.com |

| 🇴🇲 Oman | 201, Areen Towers, Azaiba, Oman | zvs.oman@zvsinternational.com |

| 🇬🇧 London (Partner Office) | — | zvs.uk@zvsinternational.com |

Introduction to Trade Finance and Risk Management Division

ZVS International Group is a global leader with a diverse portfolio of business interests. Our Trade Finance and Risk Management Division is dedicated to delivering innovative, secure, and flexible trade finance solutions tailored to the unique needs of international businesses—all without requiring any collateral or margin money. With over 15 years of specialized experience, we have empowered clients worldwide to navigate the complexities of global finance with unmatched confidence.

Our team is composed of more than 35 seasoned professionals, including former bankers, CFOs, and experts in trade finance instruments. This wealth of expertise allows us to offer our clients the flexibility they need to succeed, without the traditional barriers that make accessing financial tools challenging. We provide a comprehensive range of services—securing Letters of Credit, monetizing assets, managing financial risks—while ensuring the utmost security and reliability for your investments.

At ZVS International, we are more than service providers; we are your strategic partners in finance. We take the time to understand your specific goals and challenges, offering expert guidance on the best financial instruments to suit your business objectives. Our solutions are designed to adapt to changing market conditions while prioritizing the security of your assets, so you can focus on what matters most—growing your business.

With three decades of combined expertise, our Trade Finance and Risk Management Division delivers seamless solutions that make international trade transactions efficient, secure, and worry-free. Our adherence to global banking standards and industry best practices guarantees that your financial interests are protected, with no need for upfront collateral or margin payments.

Choosing ZVS International means partnering with a firm that prioritizes your financial security and growth. Our commitment to providing collateral-free financial instruments ensures that you have the flexibility to expand, adapt, and thrive in the global marketplace—without unnecessary financial constraints.

Key Service Offerings in Trade Finance and Risk Management

The Trade Finance and Risk Management Division provides an extensive range of trade finance instruments tailored to various transaction stages and financial needs.

Trade Finance Instruments

- Proof of Funds (POF): Aids clients in demonstrating financial capability for high-value transactions, building trust without requiring immediate capital deployment.

- Standby Letter of Credit (SBLC): Secures payment in the event of buyer default, ideal for high-value, cross-border transactions requiring additional assurance.

- Documentary Letter of Credit (DLC): Ensures transparency by releasing payment only when agreed terms are met, protecting both buyer and seller.

- Usance Letter of Credit: Defers payment to allow cash flow optimization in long trade cycles, providing greater flexibility for buyers.

- Sight Letter of Credit: Guarantees immediate payment upon document presentation, suitable for time-sensitive transactions.

Guarantees

- Advance Payment Guarantee: Provides buyers confidence in advance payments, returning the advance if seller obligations aren’t met.

- Performance Bank Guarantee: Covers buyer interests if the seller fails to perform, commonly used in sectors like construction, manufacturing, and supply agreements.

Specialized Solutions

- Block Funds: A set amount is reserved in the client’s account, showcasing fund availability for a specified period, often essential in high-value transactions.

- Platform Trading – Small and Mid-Cap Programs: Offers qualified clients structured platform trading options, allowing diversification and stable returns in small and mid-cap trading programs.

- MT799: Pre-advises SWIFT messaging for transaction funds availability, building confidence before high-value commitments.

Monetization of Financial Instruments

Through monetization services, ZVS International transforms assets like SBLCs, DLCs, and POFs into liquid funds, allowing businesses to leverage their assets as working capital without new debt obligations.

Business Setup and Banking Solutions in Various Jurisdictions

The Trade Finance and Risk Management Division provides end-to-end business setup and banking solutions in multiple jurisdictions. Our team simplifies offshore and mainland banking setups, ensuring smooth entry into new markets and full regulatory compliance, which lets clients focus on business expansion without administrative burdens.

Key Benefits

AML Compliance and Due Diligence

ZVS International is committed to maintaining the highest levels of security and transparency in all transactions. To uphold these standards, the Trade Finance and Risk Management Division follows strict Anti-Money Laundering (AML) regulations. This compliance process is necessary to:

- Ensure each client’s identity and legitimacy.

- Easily import a sample demo to get started with a fully built site you can tweak.

- Safeguard against financial crimes such as money laundering, fraud, and terrorism financing.

- Protect the security and integrity of our trade finance services for all clients.

Due Diligence Procedure

In cases requiring further verification, we conduct a Due Diligence procedure, assessing transaction backgrounds and risk factors. A non-refundable fee may apply in some situations, allowing us to complete thorough vetting, ensuring our services align with global compliance standards.

How It Works (Step-by-Step Guide)

Initial Inquiry

Contact our team for a needs assessment.

Issuance of Instrument

Based on assessment, select the best instrument (e.g., SBLC, Advance Payment Guarantee).

Document Submission

Submit necessary documents for verification

Monetization or Utilization

Instruments can be monetized upon request or directly utilized in trade transactions.

Financial Calculators

Real-time calculators for cost and return estimation, helping clients make well-informed decisions.

AI Chatbot

Support

Available 24/7 to answer inquiries, navigate service information, and collect initial client details.

Application Details

Customer Information Sheet (CIS)

Complete applicant information, including contact and identification.

Bank Name

Specify the bank issuing the trade finance instrument.

Face Value

Indicate the desired value of the financial instrument.

Purpose

State the intended use of the trade finance instrument.

Beneficiary Details

Complete beneficiary information, including name and bank details.

Case Studies

Case Study 1: $20 Million SBLC for Sugar Import – No Collateral Required

Challenge: A trading company faced tight deadlines to secure a $20 million SBLC for sugar imports. Traditional banks required high collateral, risking the deal and liquidity.

Solution: ZVS International provided the SBLC without collateral or margin money, leveraging our financial network and expertise to deliver a fast, reliable solution.

Outcome:

- Secured the import contract within deadlines.

- Preserved liquidity for operations.

- Expanded market share and business credibility.

Case Study 2: Collateral-Free DLC and Usance LC for Machinery Procurement

Challenge: A client supplying to a top global refinery required $15 million in trade instruments to procure advanced machinery. Collateral demands from banks hindered progress.

Solution: We issued DLCs and Usance LCs without collateral, tailored to the refinery’s procurement policies, ensuring compliance and meeting deadlines.

Outcome:

- Successful machinery procurement on time.

- Strengthened partnership with the refinery.

- Enhanced production efficiency and profitability.

Case Study 3: LC for OEM Laundry Equipment Import from China

Challenge: A laundry sector client needed to import advanced OEM equipment but lacked collateral to back an LC.

Solution: ZVS International issued a secure LC without collateral, meeting supplier requirements and accelerating the transaction process.

Outcome:

- Imported cutting-edge equipment seamlessly.

- Boosted operational efficiency.

- Built trust with international suppliers.

Summary

ZVS International empowers businesses with innovative, collateral-free trade finance solutions, enabling clients to seize global opportunities, enhance liquidity, and secure successful outcomes efficiently.

Testimonials and Case Studies

Feel free to contact us for any questions or concerns. We will respond as soon as possible.